Understanding Divorce Financial Rights:

Guide for Women's Financial Security

While marriage celebrates the union of two lives, divorce necessitates the complex untangling of shared finances, assets, and responsibilities. In South Africa, where approximately 4 out of 10 marriages end in divorce, understanding the financial implications becomes crucial for protecting one's economic future.

The intersection of legal rights, financial obligations, and personal circumstances creates a unique landscape that demands careful navigation. For women in particular, who may have sacrificed career advancement for family responsibilities, securing financial independence through proper asset division and maintenance arrangements becomes paramount.

Asset Division

South African Marital Regimes

In South Africa, the division of assets during divorce depends on the marital regime chosen at the time of marriage. Under the in community of property regime, all assets and liabilities acquired before and during the marriage form part of a joint estate, which is divided equally between spouses upon divorce.

When married out of community of property with accrual, spouses maintain separate estates for assets acquired before marriage, while the growth in asset value during marriage is shared equally. The accrual system provides financial protection while maintaining individual ownership rights.

Marriages out of community of property without accrual maintain complete separation of estates, with each spouse retaining their assets acquired both before and during marriage.

Court Considerations for Asset Division

Courts carefully evaluate both economic and non-economic contributions when determining asset division. Financial contributions, including income and investments, are weighed alongside non-monetary contributions such as household management and childcare duties. Additional factors that influence division include:

- Duration of the marriage

- Standard of living established during marriage

- Financial capacity and obligations of each spouse

- Age and health status of parties involved

The court may deviate from standard division principles when circumstances warrant special consideration, ensuring equitable distribution based on each case's unique factors.

Spousal Maintenance

Understanding Support Obligations

Spousal maintenance in South African law operates as a gender-neutral financial support mechanism, designed to assist economically disadvantaged spouses following divorce. Either spouse may be required to provide financial support, depending on their respective financial positions and earning capabilities.

Claiming Maintenance

Spouses can establish maintenance arrangements through two primary methods. The first involves a written settlement agreement negotiated between parties during divorce proceedings. Alternatively, when parties cannot reach consensus, the court may issue a maintenance order based on the case circumstances.

Determining Factors

Courts consider multiple elements when awarding spousal maintenance:

- Current and potential earning capacity of each spouse

- Physical health and age considerations

- Length of the marriage relationship

- Standard of living during marriage

- Financial obligations and available assets

- Spouse's ability to become self-supporting

- Conduct relevant to the marriage breakdown

The amount and duration of maintenance payments vary significantly based on these factors. In some cases, maintenance may be awarded temporarily to allow the recipient spouse to become financially independent, while in others, long-term support may be necessary due to age, health, or limited earning potential.

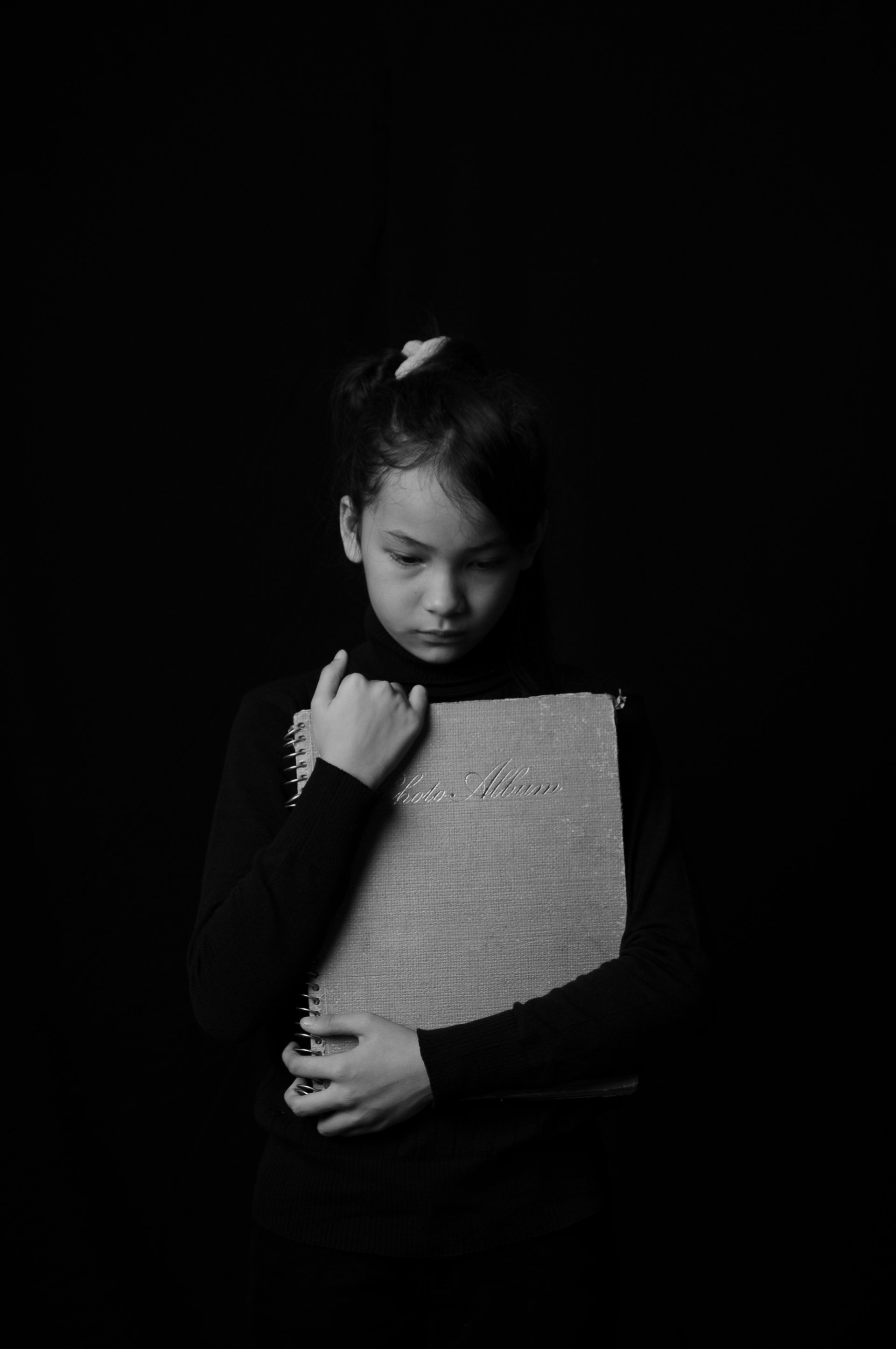

Child Custody and Maintenance

Determining Child Custody

Child custody arrangements in South African law prioritize the best interests of the child above all other considerations. Courts evaluate multiple factors to establish optimal custody arrangements, including:

- The child's physical and emotional security

- Each parent's ability to provide stable care

- Existing bonds between the child and each parent

- The child's educational needs and continuity

- Parents' capacity to cooperate in decision-making

Maintenance Calculations

Child maintenance determinations follow a comprehensive assessment of legitimate expenses essential for the child's welfare. These calculations encompass:

- Educational costs including school fees and materials

- Medical expenses and healthcare coverage

- Basic necessities such as food and clothing

- Reasonable recreational activities

- Transportation expenses

Essential Expenses Coverage

The court places significant emphasis on ensuring essential expenses are adequately covered through maintenance arrangements. School fees receive particular attention as education represents a fundamental right and long-term investment in the child's future. Medical expenses, including health insurance coverage, must be factored into maintenance calculations to safeguard the child's physical well-being. Basic necessities like food, clothing, and shelter form the foundation of maintenance considerations, ensuring the child maintains an appropriate standard of living post-divorce.

Financial Independence

Managing Post-Divorce Finances

Financial autonomy after divorce requires careful planning and strategic management of resources. Establishing a comprehensive budget that accounts for new financial circumstances is essential. This budget should categorize expenses into fixed obligations and discretionary spending, with priority given to essential costs that maintain financial stability.

Critical Financial Obligations

Several key expenses demand immediate attention in post-divorce financial planning:

- Childcare costs, including daily supervision and emergency care arrangements

- Life insurance premiums to protect dependent children and secure their future

- Medical aid contributions to ensure continuous healthcare coverage

- Emergency fund contributions for unexpected expenses

- Retirement planning and investment contributions

Building Financial Security

Implementing a structured savings and investment strategy is crucial for long-term financial independence. Consider:

- Establishing separate bank accounts for different financial goals

- Maintaining an emergency fund covering 3-6 months of expenses

- Investing in diverse financial instruments based on risk tolerance

- Regularly reviewing and adjusting investment portfolios

- Consulting financial advisors for personalized wealth management strategies

Prioritize debt management alongside saving efforts, focusing on high-interest obligations first. Regular financial health assessments help ensure progress toward economic independence and stability.

Essential Documents and Legal Process

Required Documentation

The divorce process requires specific documentation to proceed effectively. Essential documents include:

- Original or certified copy of marriage certificate

- Identity documents of both spouses

- Detailed financial statements showing income and expenses

- Bank statements covering the past 12 months

- Proof of assets and liabilities

- Tax returns and assessments

- Pension fund statements

- Property ownership documentation

- Vehicle registration papers

- Medical aid membership certificates

Divorce Process in Port Elizabeth

The path to divorce in Port Elizabeth follows two distinct routes: contested and uncontested proceedings. Uncontested divorces proceed when spouses agree on all terms, including asset division, maintenance, and child custody arrangements. This process typically concludes within 4-6 weeks.

Contested divorces arise when spouses disagree on key issues. This process involves:

- Filing of summons and particulars of claim

- Exchange of pleadings between parties

- Discovery of documents

- Pre-trial conferences

- Court appearances and potential mediation

- Final hearing and judgment

The timeline for contested divorces varies significantly, potentially extending several months to years, depending on complexity and level of dispute. Courts encourage parties to reach settlement agreements wherever possible to minimize emotional and financial costs.

Expert Opinions and Resources

Professional Legal Guidance

Experienced divorce attorneys emphasize the importance of comprehensive legal representation throughout divorce proceedings. Legal professionals consistently advise clients to maintain detailed financial records and seek guidance before making significant decisions regarding asset division or maintenance agreements. Key recommendations from seasoned practitioners include:

- Conducting thorough financial disclosure early in the process

- Documenting all marital assets and liabilities meticulously

- Securing professional valuations for substantial assets

- Maintaining clear communication channels through legal representatives

- Preserving evidence of contributions to the marriage

Available Support Resources

For individuals seeking additional guidance, several reliable resources provide valuable information and support:

- Pauw Attorneys' comprehensive online portal offers detailed insights into divorce proceedings

- Legal aid clinics provide assistance for those requiring financial support

- Family law specialists offer initial consultations to assess case specifics

- Professional mediators facilitate alternative dispute resolution

- Financial advisors specializing in post-divorce planning

Legal professionals recommend consulting multiple sources while maintaining primary contact with a qualified attorney. This approach ensures balanced decision-making while protecting individual legal rights throughout the divorce process. Regular consultation with legal counsel helps navigate complex procedures and ensures compliance with court requirements.

Securing Your Financial Future

Navigating divorce proceedings requires a balanced approach combining legal expertise, financial planning, and emotional resilience. The key to emerging financially secure lies in understanding your rights, maintaining comprehensive documentation, and seeking professional guidance throughout the process.

Building post-divorce financial independence demands careful consideration of both immediate needs and long-term goals. By leveraging available resources, maintaining clear communication through legal representatives, and implementing strategic financial planning, individuals can establish a stable foundation for their future economic well-being.